COUNTRIES UNDER FINANCIAL STRESS COULD EASE OIL SECTOR ENTRY TERMS THIS YEAR, ACCORDING TO PFC ENERG

Wpisał: PFC Energy Press Release

WASHINGTON, DC (February 17, 2009)—Lower oil prices and declining revenues could force some states to adjust their fiscal terms this year, according to a recent study by PFC Energy’s Petroleum Risk Manager service. Countries with weak government finances, declining production or immediate technical needs could make concessions in order to attract investment. International oil companies (IOCs) may find greater negotiating leverage in states that include Venezuela, Ecuador and Algeria.

Over the past few years, rising oil prices and dwindling investment opportunities for oil companies gave greater leverage to resource holders, and many countries responded by tightening their contract terms. Those conditions have changed, and many oil producing countries will find that their relative power has diminished. Sustained low oil prices will add to the financial strain on state budgets, forcing a policy response. Countries that introduced windfall profits taxes will see declining participation in new bid rounds, and IOCs will push for more favorable terms in bilateral negotiations.

While frontier countries with minimal oil production already have favorable contract terms, struggling producers with mature basins and rapidly declining production may be forced to loosen their fiscal terms to attract investment.

Among the more vulnerable states will be Venezuela and Ecuador. Venezuela’s national oil company PDVSA is facing severe cash flow problems, and unrestrained state spending has left Venezuela highly exposed to the downturn in oil prices. Even before the financial crisis, Caracas had been signaling its interest in greater foreign investment, particularly for heavy oil in the Orinoco Belt. A May 2009 licensing round will test the government’s willingness to introduce lower taxes and royalties for IOCs that can offset PDVSA’s financial and technical limitations. Ecuador, like Venezuela, dramatically increased taxes on oil companies last year, and several foreign investors agreed to convert to less favorable service contracts in late 2009. But Ecuador’s government—which recently defaulted on its external debt—will be hard-pressed to implement those changes.

Most of the large oil producers in the Middle East and North Africa are well-positioned to ride out the downturn in oil prices. However, several countries have specific technical needs that require foreign investment—and could be forced to make some concessions on contract terms. Algeria faces a host of upstream challenges that are jeopardizing its gas export targets. After an unsuccessful bid round in December 2008, Algeria could adopt a softer negotiating stance with companies interested in tight or deep gas developments.

Notes to the Editor

PFC Energy, headquartered in Washington, DC, is a leading strategic advisory firm in global energy with main offices in Houston, Kuala Lumpur, Paris, Beijing, Bahrain, Lausanne and Buenos Aires. PFC Energy’s clients include all major international oil and gas companies, many national oil companies, oilfield service companies, financial institutions and government agencies and ministries involved in energy policy and energy-driven economic development. PFC Energy’s coverage includes competitor analysis, energy sector strategies (exploration and production, natural gas, refining and marketing), commercial opportunities, short and long-term oil, gas and product market projections, carbon strategy and geopolitical forces affecting energy policy and energy economics.

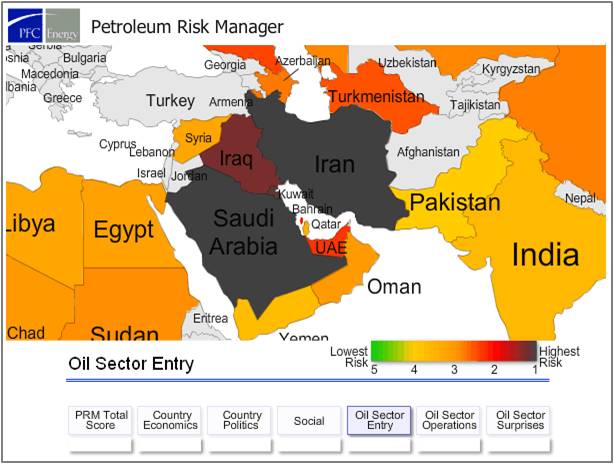

PFC Energy’s Petroleum Risk Manager (PRM) service evaluates above-ground risk in 59 countries—including politics, economics, entry terms, and operational risks—to give clients an objective, rigorous way to compare risk across countries.

source: PFC Energy Press Release

Further information

On PFC Energy:

Erika Smakula

info_esmakula@pfcenergy.com

(1 202) 872-1199

On the Petroleum Risk Manager

Ben Cahill

bcahill@pfcenergy.com

(1 202) 721-0321